Standard Chartered Bank Nigeria: USSD Codes, mobile banking, contacts & more

Standard Chartered Bank Nigeria is a subsidiary of Standard Chartered Bank Plc, headquartered in the UK. This bank has around 1,000 employees across 20+ branch offices in Nigeria alone. In this post, we’ve provided the key things you need to know about Standard Chartered and the banking services they offer.

An overview of Standard Chartered Bank Nigeria

Standard Chartered Plc is a British multinational financial services company headquartered in London, England.

It has over 1,200 branches, outlets, subsidiaries, associates and joint ventures in more than 70 countries. Around 90,000 people work with SC Bank.

Standard Chartered Bank Nigeria is a subsidiary of Standard Chartered Bank Plc. Banking operations started in Nigeria in 1894 but were paused during the civil war.

It was later resumed in 1999 and today, SC Bank has around 1,000 employees and 20+ branch locations in Nigeria.

Standard Chartered internet banking

Standard Chartered Bank internet banking allows existing users to control their finances and make transactions on the web without any paperwork or physical presence in a bank branch.

Registration for Standard Chartered internet banking

You will need the following to register for SC internet banking:

- A phone number already linked to your SC bank account

- Account number details

- ATM/Credit/Debit card details

- Bank Verification Number (BVN)

You can visit this page to sign up for SC internet banking.

Log in to Standard Chartered internet banking

Visit the page here to sign in to your SC internet banking account.

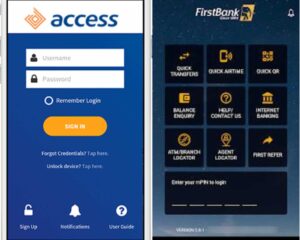

Standard Chartered mobile banking

SC Bank has a reliable mobile and digital solution for customers that want to bank on their mobile phones. It will give you fast, easy access to your accounts, help you track your funds, and stay in control of your finances.

Key features

- No charge for all interbank local transfers

- Zero SMS transaction charges

- Free Gold Visa Debit/ATM card (first issuance)

- Free card delivery to your mailing address anywhere in Nigeria

- Zero cash withdrawal charge on any 3rd party ATM in Nigeria, regardless of the number of withdrawals

- Request for a card, block or replace it

- Activate your debit/credit card, choose a PIN and reset your PIN

- Book fixed deposits

- Order for chequebook and confirm cheques

- Request for bankers’ draft

- Request account statements

- Request for Reference letters

How to download the Standard Chartered Mobile app

Android

You can download and install the SC Mobile App from the Google Play Store. It has a size of 70 MB and over 500,000+ downloads. It currently has a review rating of 3.3 from over 8,000 users.

iOS

If you’re using an iPhone device, you can download and install the SC Mobile App from the Apple App Store.

Standard Chartered USSD Banking

The Standard Chartered Bank USSD code is *977#. You can access this code from any network, but it should be the phone number linked to your bank account.

SC USSD codes

- *977*911#: USSD block services

- *977*00#: Check your account balances

- *977*Amount#: Direct airtime for your phone number

- *977*Amount*Phone Number#: Airtime Top-up for other numbers

- *977*Amount*Account No#: Direct transfer to any account number

- *977*2#: Data subscription for your phone number

- *977*2*Phone Number#: Data subscription for other numbers

Customer care

For questions and complaints, you can always contact Standard Chartered Bank. They have customer support staff that will attend to you.

Customer care number

- +234 270 4611 – 4

- +234 800 123 5000

- Clientcare.ng@sc.com

- Straight2bank.ng@sc.com

Head office address

Standard Chartered has a head office in Nigeria where they manage the banking services they offer. You can also visit the office if you have any complaints. It is located at 142 Ahmadu Bello Way, Victoria Island 106104, Lagos, Nigeria.

Standard Chartered financial products, services, and account types

Personal Banking

This is an account type that allows customers to make banking transactions effectively and conveniently.

Standard Chartered Women Current Account

This is a current account that enables customers of the female gender to save, upgrade their lifestyles and make room for development.

Salary Account

Here’s a Standard Chartered bank account specially made for salary earners. You can use this account to receive money from any company/organization you work with. There are also many other benefits attached.

Savings Account

If you’re someone that needs a convenient banking service, but you don’t spend regularly, then a savings account may be worth a try.

ESAVER Account

Standard Chartered ESAVER allows customers to save for their future financial goals.

Education Saver Account

Here’s a High yield savings account that encourages you to save for your child’s education.

Fixed Deposit Account

A fixed deposit account with SCBN allows customers to invest their funds for a fixed period and make profits at higher interest rates.

Credit Cards

One of the financial products of Standard Chartered Bank is its credit card.

- Up to 5 supplementary cards

- Recognized by 23 million merchant points. You can also use them on the internet

Debit cards

- Get up to 15% discount from partner merchants

- There’s no card usage fee for cash withdrawals on any bank’s ATM in Nigeria

- You can apply for a Standard Chartered debit card directly from the SC mobile app and get free delivery

Standard Chartered loans and mortgages

Personal Loan

- You can repay within a duration of up to 60 months

- The interest rate is 1.083% per month

- Apply for and obtain a loan amount of up to ₦20 million

Requirements

- If you work with a corporate organisation: Your monthly income must be at least ₦75,000

- If you work with the government: Your monthly income must be at least ₦50,000

Learn more and apply for Standard Chartered Personal Loan.

Overdraft Loan

- Flexible interest rates

- Obtain an amount up to ₦1.8 million

- You can make overdrafts from your accounts every month

Requirements

- You must have a salary account with Standard Chartered Bank Nigeria

- You must have good credit bureau history

- You must have a monthly income of at least ₦50,000 regardless of the company you’re employed in

Learn more and apply for a Standard Chartered Overdraft loan.

Mortgage

- 15% interest rates per year

- Repay within 20 years (longer tenor subject to a maximum age of 60 years)

- Get a loan amount of up to ₦220 million

Requirement

- Interested customers must have a stable monthly income of at least ₦350,000

Learn more and apply for a Standard Chartered Mortgage.

How to apply for Standard Chartered loans, overdrafts and mortgages

You can visit the Standard Chartered loan page to see all loans, overdrafts, mortgages, and their application processes. For the fastest experience, you should get in touch with their customer support or visit a physical branch.

Website

Standard Chartered Bank Nigeria has a website where you can see all information about them on the web. See their website here. Sc.com/ng.

Standard Chartered Bank Swift Code information

A SWIFT code is a set of 8 or 11 digits that represents a bank branch. You’ll need to use one when sending money internationally.

| Swift Code | SCBLNGLA |

| Bank Name | Standard Chartered Bank Nigeria Limited |

| Branch Code | PYT |

| Bank Address | Unitrust House, 105b Ajose Adeogun Street, Victoria Island, Lagos Nigeria |

| City | Lagos |

| Country | Nigeria |

Standard Chartered Bank Nigeria: Bank branches and ATM locations

If you’re trying to locate a Standard Chartered branch or ATM in any part of the world, this article has you covered. Visit the Standard Chartered branch locator to get the address and directions of all branches/ATMs.

Don't miss a thing. Follow us on Telegram and Follow us on WhatsApp. If you love videos then also Subscribe to our YouTube Channel. We are on Twitter as MakeMoneyDotNG.