Unlocking investment opportunities: How to purchase shares in Nigeria

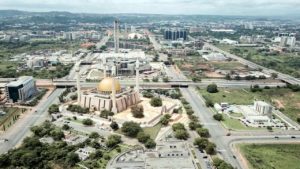

The Nigerian economy, rich in diversity and teeming with potential, offers a vast array of investment opportunities. One such opportunity lies in the purchasing of shares, where investors can partake in the growth and success of various enterprises.

With advancements in technology and regulatory systems, the process of purchasing shares has been significantly simplified, making it more accessible to both experienced investors and beginners alike.

Keep reading to find out how more about shares, the Nigerian Exchange Group (NGX), and how to buy shares in Nigeria in a few effortless steps.

Understanding Shares and Their Importance

What are Shares?

Shares represent company ownership, with shareholders entitled to a portion of the company’s assets and earnings. They are a means of raising capital for companies, and for investors, they offer the potential for financial returns through capital appreciation and dividends.

Why are Shares Important?

Shares are a critical component of a balanced investment portfolio. They offer the potential for high returns, though they can also pose significant risks.

Investing in shares can help diversify your investment portfolio, spread risk, and potentially provide a steady income stream through dividends.

Getting Started with Shares in Nigeria

The Role of the Nigerian Exchange Group (NGX)

The Nigerian Exchange Group (NGX) is the heart of Nigeria’s stock trading. This is where the stocks of various companies are listed and traded.

Understanding the intricacies of NGX is a crucial first step in purchasing shares. The NGX provides a transparent and efficient platform for buying and selling securities, contributing to developing the country’s financial market.

Registering with a Stockbroker

To buy shares on the NGX, you must first register with a licensed stockbroker. These are firms or individuals licensed by the Nigerian Exchange Group (NGX) and the Securities and Exchange Commission (SEC) to buy and sell securities on behalf of investors.

Furthermore, they provide crucial guidance and advice, helping investors navigate the stock market.

Once you have selected a stockbroker, you must open a brokerage account. This process typically involves filling out an account opening form and providing necessary documents such as identification and proof of address.

The Central Securities Clearing System (CSCS) Account

The CSCS plays a crucial role in the Nigerian stock market, handling the clearing, settlement, and delivery of securities transactions. Investors need to open a CSCS account through their stockbroker. This account will hold your purchased shares in an electronic format.

The Process of Purchasing Shares

Once the necessary accounts are set up, you can start buying shares. This typically involves the following steps:

- Share Selection: Research and choose the company whose shares you wish to purchase. Consider the company’s financial performance, industry position, and growth prospects.

- Place an Order: Communicate with your stockbroker to place a purchase order. Specify the company and the number of shares you wish to buy.

- Execution and Settlement: The stockbroker executes your order on the NGX. Once completed, the shares are settled through the CSCS and reflected in your CSCS account.

Navigating the Investment Landscape

Investing in shares requires careful consideration and understanding of the stock market. Continuous monitoring of the market and your investments is crucial.

The Nigerian stock market can be volatile, and while it offers the potential for significant returns, it can also present considerable risk. When investing in shares, consider your financial goals, risk tolerance, and investment horizon.

Our Final Thoughts

Investing in shares in Nigeria can open a wealth of opportunities. The process, while daunting, has been made significantly simpler with the advent of digital platforms and efficient regulatory systems. However, investing in the stock market is not without risk.

Therefore, we urge Nigerian traders to evaluate and understand their risk tolerance before investing. Furthermore, it is always a good idea to consult a financial advisor before investing.

Don't miss a thing. Follow us on Telegram and Follow us on WhatsApp. If you love videos then also Subscribe to our YouTube Channel. We are on Twitter as MakeMoneyDotNG.