GTBank vs Zenith Bank: Which offers better services?

Is GTBank better than Zenith Bank? These are arguably the two banks that are most frequently compared to each other. The reason is not far-fetched; it’s definitely because of their strong market presence, innovative approaches to digital banking, and leadership in the financial sector.

If you are here because you are searching for the same answer, this article will help a lot. Even though you may not find a definitive answer in this post, you’ll find a lot of information about these two banks to guide you in making a well-informed choice.

History and growth

Both Banks are trusted and familiar companies in the Nigerian banking sector, but how has the journey to prominence been for them? Let’s find out.

Guaranty Trust Bank

Founded in 1990 by a group of young and vibrant Nigerians, GTBank officially began its operation in 1991. The financial institution has maintained steady growth and development since then.

Guaranty Trust Bank plc became a publicly quoted company in 1996 and obtained a universal banking license from the Central Bank of Nigeria in 2022. These achievements boosted the organization’s fame and provided a solid foundation for future growth.

With over 28 million customers and 235 branches across the country, GTbank is no doubt a powerhouse in Nigeria. Meanwhile, its services are also accessible in Uganda, Ghana, Sierra Leone, the United Kingdom, Côte D’Ivoire, etc.

Zenith Bank

Zenith Bank isn’t a pushover in Nigeria’s banking industry, having been in the game for over 34 years. Established in 1990 by Jim Ovia CFR, it started operating as a commercial bank in the same year.

Fourteen years later, Zenith Bank became a public limited company, allowing the public to be a stakeholder. What started as a small business some years ago currently has 393 branches in Nigeria, and it’s the 6th largest bank in Africa. Like GTbank, Zenith boasts over 30 branches in other African countries, including Ghana, Sierra Leone, and Gambia.

Products and services

No doubt, both financial institutions offer customer-centric products and services. Here are some details about their products and services.

Guaranty Trust Bank

Guaranty Trust Bank services are categorized into four sections. They include personal, business, corporate, and investment.

1. Personal banking

The services in this category solely deal with personal banking needs. They solve immediate and personalized banking challenges. These include savings and current accounts, airtime top-ups, Bank 737, Balance inquiries, money transfers, etc. Meanwhile, below are the types of personal savings accounts you can create with GTB:

2. Business banking

As the name implies, these services are mainly for small and medium-sized business owners. They consist of SME Banking (Business accounts), low-interest loans, workshops, and advisory services. Through these services, the bank organizes seminars and get-togethers where CEOs and entrepreneurs can connect and share business insights.

The six GTB business accounts available to eligible entrepreneurs include:

- GT Business Silver

- GT Business Gold

- GT Business Platinum

- Corporate Current Account

- GTMax Account

- Domiciliary Accounts

3. Corporate banking

GTBank’s corporate banking services focus on large-scale businesses. They are services big brands require to run a smooth operation. SMEs can benefit from the services if they meet the requirements. Guaranty Trust Bank’s corporate banking products and services consist of the following:

- Tenured Deposits

- Cheque Confirmation

- Portfolio Management

- Corporate advisory services

- Project Finance

4. Investment banking

GTBank is known for its multiple investment opportunities. These services let you invest your money and enjoy a high return on investment. For instance, your account will accrue some interest rate when you fund your fixed and tenured deposit accounts.

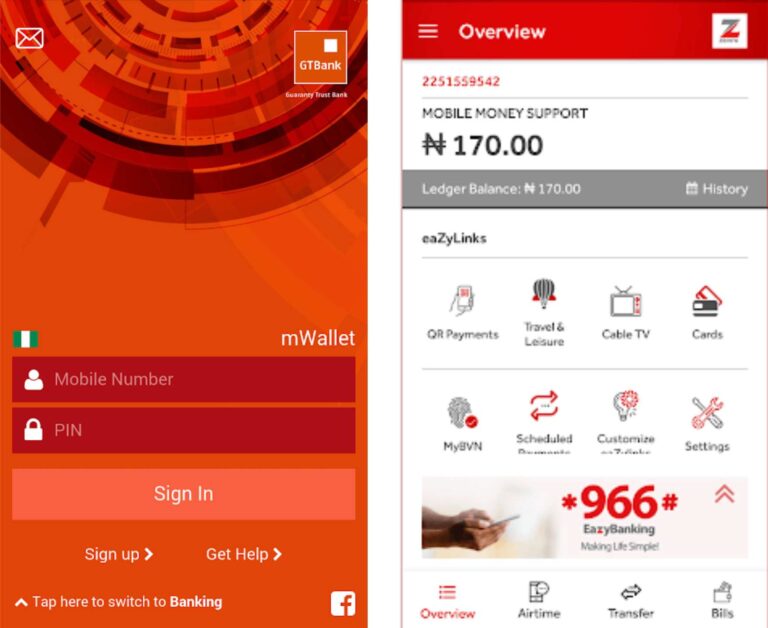

5. Mobile banking

As part of its desire to make banking simple and accessible to every Nigerian, GTBank launched its mobile banking app. It’s one of the first banks to explore the digital banking system in Nigeria through the fast and secure Gtb mobile app (GTWorld).

You can complete the following tasks on the GTBank mobile app:

- Settle bills like Cable TV, electricity, and toll fees.

- Enjoy fast and secure money transfers.

- Purchase airtime and data.

Zenith Bank

Zenith Bank is famous for its massive investment opportunities. Interestingly, it gives room for stock purchase and exchange. Hence, wealthy and eligible customers can purchase stock in the bank and sell it for more profits. While investment is one of the categories of its services, it has three other categories. They include:

1. Personal banking

Zenith Bank places much value and significance on personal banking services.

This category consists of Savings Accounts, Current accounts, Salary Accounts, USSD, low-amount transactions, and others.

Talking of Savings accounts, below are the types you can create with Zenith Bank:

- Individual saving

- Timeless Account For old Nigerians (50-77 years old)

- Zenith Eazy Account for those without BVN

- Children’s Account

- Aspire Account for students

- eaZySave Classic

- EAZYSAVE Premium.

2. Corporate services

Zenith Bank’s corporate service deals with business owners and CEOs, and they are internet-based. Hence, it is also known as the Corporate Internet Banking (CIB) service or IBank. With these services, you can:

- Carry out cross-border transactions anywhere in the world.

- Pay your staff’s monthly salaries simultaneously.

- Download transactions and monitor daily financial activities.

- Cheque confirmation.

- Multiple account transaction reports.

3. Investment

Zenith Bank has products and services for customers seeking investment opportunities. These include:

Like GTbank, Zenith offers an agreed interest rate when you put money in your fixed deposit account. Therefore, the more you fund your fixed deposit account, the more ROI you get. However, the short-term investment plan tenor ranges from 30 to 90 days.

- Zenith premium funds (ZPF):

These are products for customers interested in high-interest investments.

- Zenith bank stock:

This offer allows you to become a shareholder by purchasing a percentage of ownership. It guarantees a good return on investment if all things go well.

Other Zenith Bank investment opportunities are Call Deposit and Certificate of Deposit (CD) & Short Term Investment Fund (STIF). Visit their official page for details.

4. Digital banking solutions

Zenith Bank offers internet banking through its mobile app. With the Zenith mobile app, you access your account, transfer money, buy airtime directly from your bank, and do other activities around the clock.

Loans

As commercial banks, both give out loans and financial backing to individuals and businesses.

GTBank

| Loans | Interest | Min — Max | Tenor |

|---|---|---|---|

| Quick Credit | 2.4% monthly | ₦5,000 — ₦5 million | 6 — 12 months |

| MaxAdvance | Undisclosed | ₦100,000 — ₦10 million | 3 — 48 months |

| GTMortgage | Undisclosed | 5 million — 150 million | 1 — 20 years |

| GT School Advance | Undisclosed | ₦50,000 — ₦1 million | 4 months |

Zenith Bank

| Loan | Interest | Min — Max Amount | Tenor |

|---|---|---|---|

| Z-Woman | 16% p.a | ₦ 5000 — ₦10 million | 12 to 24 months |

| MSME Loans | 27% p.a | ₦500,000 — ₦2 million | 12 months |

| Sub-dealer Finance Scheme | 19% p.a | ₦ 5 million | 12 to 24 months |

| Education Loan | Undisclosed | ₦100,000 — ₦5 million | 3 months(High school) – 9 months (Tertiary intuition) |

| Creative Industry Financing Initiative (CIFI) | 9% p.a. | Up to ₦30 million | up to 10 years |

Other Zenith Bank loans include Export Finance Facility, Import Finance Facility, LPO Finance, and Receivable Discounting / Invoice Discounting.

Accessibility and customer support

While Zenith Bank has over 393 branches, GTbank boasts around 235 branches in Nigeria.

From the reports gathered from customers across some popular social media platforms, it appears that GTBank’s customer support is more responsive than Zenith Bank’s.

Conclusion

In summary, it can be deduced that the focus of GTBank is on digital innovation and customer convenience while Zenith Bank is larger and more corporate-oriented. So, you can never be wrong in choosing between the two banks based on the one that suits your needs and preferences.

Sources

https://www.zenithbank.com/about-us

https://www.gtbank.com/personal-banking/accounts#savings-investment-accounts

https://www.gtbank.com/business-banking/sme-banking

https://www.zenithbank.com/personal-banking/bank-accounts

https://www.zenithbank.com/personal-banking/investing

https://www.zenithbank.com/corporate-banking/loans-investment/#z-woman-business-package-sme-loans

https://www.zenithbank.com/corporate-banking/loans-investment/#lpo-finance

Don't miss a thing. Follow us on Telegram and Follow us on WhatsApp. If you love videos then also Subscribe to our YouTube Channel. We are on Twitter as MakeMoneyDotNG.