Eversend: How to use, send & receive money, account setup & more

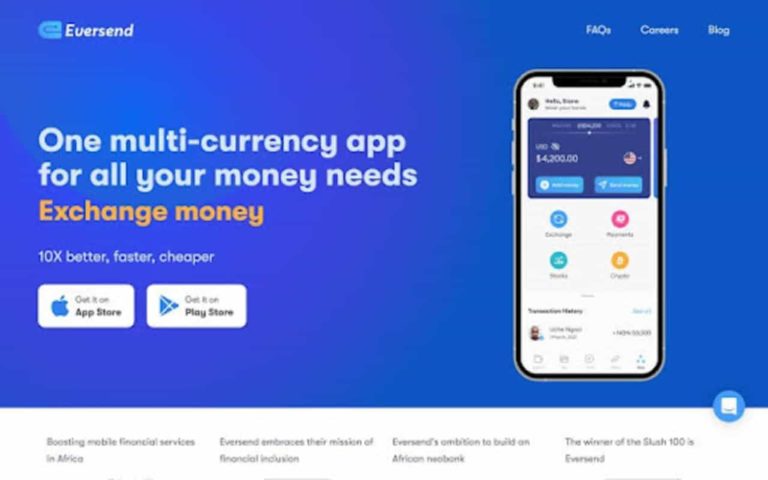

Eversend is a financial technology (Fintech) service that operates in Africa. Eversend allows Africans to exchange and send money across various countries. In this post, we will talk about how to use Eversend services.

If you want to send money out of Nigeria, Uganda, Kenya, Ghana, Tanzania & Rwanda to another country in Africa, then Eversend is the application to use. It’s fast and legit.

How does Eversend work?

Eversend works as a Fintech service for money exchange across African countries and the United States. It makes mobile and virtual transactions very easy and simple. Also, it’s international.

With an Eversend account, you can receive money into your Nigerian, Ghanian, Ugandan, Kenyan, or any of the supported countries’ bank account from the United States. You can also receive funds from the US into your Eversend account.

This also applies to other African countries like Tanzanian and Rwanda. With the Eversend mobile app, you can pay your utility bills, buy airtime and even renew your data subscription.

Transactions are free on Eversend, as long as it involves sending funds from one Eversend account to another. This applies to all countries where the Eversend service is available.

If you are residing in the United States and you want to send money to a recipient in Nigeria, you can make use of Eversend. The money will be credited into the beneficiary’s Nigerian bank account. This can be GTBank, Firstbank, Zenith Bank or any other Nigerian bank.

You can also generate your virtual cards by using the Eversend app. Such virtual cards can be used to make payments on online stores and platforms. Common examples are Netflix, Amazon, Google, Facebook and Apple Music.

Benefits of using Eversend

- Send money across 7 different countries

- You can own wallets for each of the 7 countries, no matter your citizenship

- With Eversend financial services, you can exchange currencies at rates up to 70% cheaper than your local banks

- You can create a virtual USD card and shop on American e-commerce sites

- Through the Eversend app, you can receive money from a US resident into your Nigerian bank account

- You can also top up your airtime and pay for utility bills by using the Eversend mobile app

Is it safe to use Eversend?

The Eversend mobile app is very safe to use. It is founded, owned, and controlled by the Ugandan entrepreneur Stone Atwine.

It is legit and so far, no user has ever complained of being defrauded by the Eversend financial service.

Eversend supported countries

Eversend is available in 7 different countries. They include:

- Nigeria (NGN) 🇳🇬

- The United States (USD) 🇱🇷

- Kenya (KES) 🇰🇪

- Ghana (GHS) 🇬🇭

- Tanzanian (TZS) 🇹🇿

- Uganda (UGX) 🇺🇬

- Rwanda (RWF) 🇷🇼

Requirements to open an Eversend account

Apart from being at least 18 years old, you will need to provide the following information.

- Email address

- Phone number

- Full name

- Date of birth

- A form of national identification (Driver’s License, National ID or Passport) with at least 3 months validity

- A selfie that clearly shows your face

Eversend mobile app download

Since you now know the things you need to create an Eversend account, you should proceed with downloading the Eversend mobile app.

You can download the Eversend app from the Google Play Store (for Android devices) and Apple App Store (for iOS devices). Click here to download it for any device.

How to open an Eversend account?

To create your Eversend account, see the procedure below.

- Install and start the Eversend mobile app

- Provide your email address

- Enter your country code and phone number

- A confirmation code will be sent to your number as an SMS. Input the code to proceed

- Fill in your profile details. This includes your full name and date of birth

- Create a password for the mobile app security

- Set up your 4-digit PIN that will secure your transactions

How to deposit money into your Eversend account?

You can deposit money into your Eversend account by linking a debit or credit card to it. Note that only VISA and Mastercard cards are supported on the Eversend app.

To add your debit or credit card, follow the steps below.

- Navigate to the “Balance” tab

- Press the plus button tagged “Add Money”

- Tap on the plus button labelled “Add new credit/debit card”

- Fill in your card details

- A fee of 1 USD (or its equivalent) will be automatically deducted

- The credit/debit card will be linked to your account and can be used at anytime

How to send money on Eversend mobile app?

To send money to another Eversend user:

- Locate the “Send” Tab

- Select “Eversend” from the list of options

- Select a beneficiary if you have it saved already

- If sending to someone new, press the “Plus” button to add the user

- Input the amount you would like to send and submit

How to withdraw money from Eversend into your bank account?

To withdraw an amount of money into your Nigerian or Kenyan bank account, see the procedure below.

- Navigate to the “Withdraw” tab

- Input your account details (or click your own linked ATM card if you have already linked it)

- Input the amount you want to withdraw

- Confirm the details and submit

Kindly note that direct withdrawal into a local bank account is enabled only in Nigeria and Kenya.

Other African countries like Ghana, Kenya, Rwanda, and Uganda can withdraw through mobile money.

Eversend website

Eversend has a website where you can learn more about their financial services. You can visit the homepage here.

Eversend head office address

Eversend has head offices in Nigeria and Uganda. The Nigerian head office is located at 7A Milverton Rd, Ikoyi, Lagos, Nigeria.

The Uganda head office is situated at 14-18 Cooper Road, Kampala, Uganda.

Don't miss a thing. Follow us on Telegram and Follow us on WhatsApp. If you love videos then also Subscribe to our YouTube Channel. We are on Twitter as MakeMoneyDotNG.