Digital currency: meaning, how it works and more

Digital currency is a type of virtual currency that is exchanged over the internet without the need for a central bank or government. The popularity of digital currencies has grown exponentially in recent years, with more people seeing the potential benefits of this decentralized form of money. However, the concept of digital currency can be complex and confusing to many individuals.

This article aims to provide a clear understanding of digital currency, its meaning, and how it works.

What is digital currency?

Digital currency is a form of virtual currency that operates independently of a central bank or government. Instead, it uses encryption techniques to secure transactions and control the creation of new units. The most well-known digital currency is Bitcoin, which was introduced in 2009 and has since gained significant popularity and value.

Understanding Digital Currency

The most popular kind of digital currency is cryptocurrency, which is created through a process known as mining, which involves using computer power to solve complex mathematical problems. Once a problem is solved, a new block of currency is created and added to the blockchain – a public ledger of all transactions that have occurred within the network. This decentralized system allows for transparency and security, as all transactions are verified by multiple nodes within the network.

Digital currency can be stored in a digital wallet, which is typically accessed through a computer or mobile device. These wallets can be used to send and receive digital currency, as well as to view transaction history and check account balances.

How digital currency works

Digital currency operates on a peer-to-peer network, meaning that transactions occur directly between users without the need for a third party or intermediary. When a user sends digital currency to another user, the transaction is verified by multiple nodes within the network to ensure that the sender has sufficient funds and that the transaction is legitimate. Once verified, the transaction is added to the blockchain and becomes part of the public ledger.

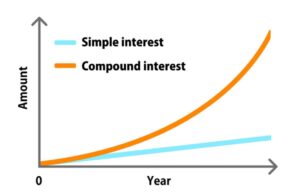

Digital currency transactions are typically faster and cheaper than traditional banking transactions, as they do not require the same level of processing and verification. However, they can also be more volatile and subject to fluctuation in value, as digital currency is not backed by any physical assets or government guarantee.

To use digital currency, users must first obtain it through a process known as mining, purchasing, or receiving it as payment for goods or services. Once obtained, digital currency can be stored in a digital wallet and used to make purchases or transfer funds to other users.

Digital currency has the potential to revolutionize the way we think about money and financial transactions. As technology continues to advance, we can expect to see new developments and innovations in the digital currency space. However, it is important for individuals to educate themselves and weigh the risks and benefits before engaging in digital currency transactions.

Pros and Cons of using digital currency

There are several potential benefits to using digital currency. One of the biggest advantages is that digital currency transactions can be faster, cheaper, and more secure than traditional banking transactions. Because digital currency operates on a decentralized network, there is no need for intermediaries such as banks or credit card companies, which can reduce transaction fees and processing times.

Digital currency can also be more accessible to individuals who do not have access to traditional banking services. In many parts of the world, people do not have access to banks or credit cards, but they may be able to use digital currency to make purchases or transfer funds.

Another advantage of digital currency is the potential for privacy and anonymity. Digital currency transactions can be made without revealing personal information, which can protect users from identity theft or fraud.

However, there are also some potential drawbacks to using digital currency. One of the biggest concerns is the volatility of digital currency values. Digital currencies can fluctuate widely in value, which can make it difficult to predict the worth of an investment.

There is also a risk of fraud or hacking, as digital currency transactions are not always backed by physical assets or government guarantees. In addition, because digital currency operates on a decentralized network, there is no central authority to regulate or oversee transactions.

The future of digital currency: trends and predictions

As digital currency continues to grow in popularity, there are several trends and predictions for the future of this emerging technology. One trend is the increasing acceptance of digital currency by mainstream businesses and financial institutions. Major companies such as Tesla and PayPal have started accepting digital currency as a form of payment, and some banks are exploring the use of digital currency for international transfers.

Another trend is the development of new digital currencies and blockchain-based technologies. While Bitcoin is currently the most well-known digital currency, there are thousands of other digital currencies in existence, each with its own unique features and advantages.

There is growing interest in the use of blockchain technology beyond digital currency. Blockchain has the potential to be used in a wide range of industries, from healthcare to supply chain management, to create more secure and efficient systems.

Despite these trends, there are still many challenges and uncertainties facing the future of digital currency. One challenge is the need for greater regulation and oversight to protect consumers and prevent fraud. There is also a need for increased education and awareness about digital currency, as many people are still unfamiliar with this emerging technology.

Navigating the risks: staying safe with digital currency transactions

Navigating the risks associated with digital currency transactions is crucial for anyone considering investing in or using digital currency. One of the biggest risks is the potential for fraud or hacking, as digital currency transactions are not always backed by physical assets or government guarantees.

To stay safe with digital currency transactions, it is important to research and choose reputable digital currency exchanges or wallets. It is also important to use strong passwords and two-factor authentication to protect against unauthorized access to digital currency accounts.

In addition, individuals should be aware of the potential for phishing scams or other fraudulent activity. This can include unsolicited emails or phone calls claiming to be from a digital currency exchange or wallet provider. It is important to verify the authenticity of any communication before providing personal or financial information.

Conclusion

Digital currency is a form of virtual currency that uses encryption techniques to secure transactions and control the creation of new units. While digital currency is still relatively newer compared to fiat currency and subject to change, it has the potential to revolutionize the way we think about money and financial transactions. Digital currency is becoming more widely accepted and is likely to continue growing in popularity as technology advances and more people recognize its potential. As with any investment or financial decision, it is important to educate oneself and weigh the risks and benefits before engaging in digital currency transactions.

Don't miss a thing. Follow us on Telegram and Follow us on WhatsApp. If you love videos then also Subscribe to our YouTube Channel. We are on Twitter as MakeMoneyDotNG.